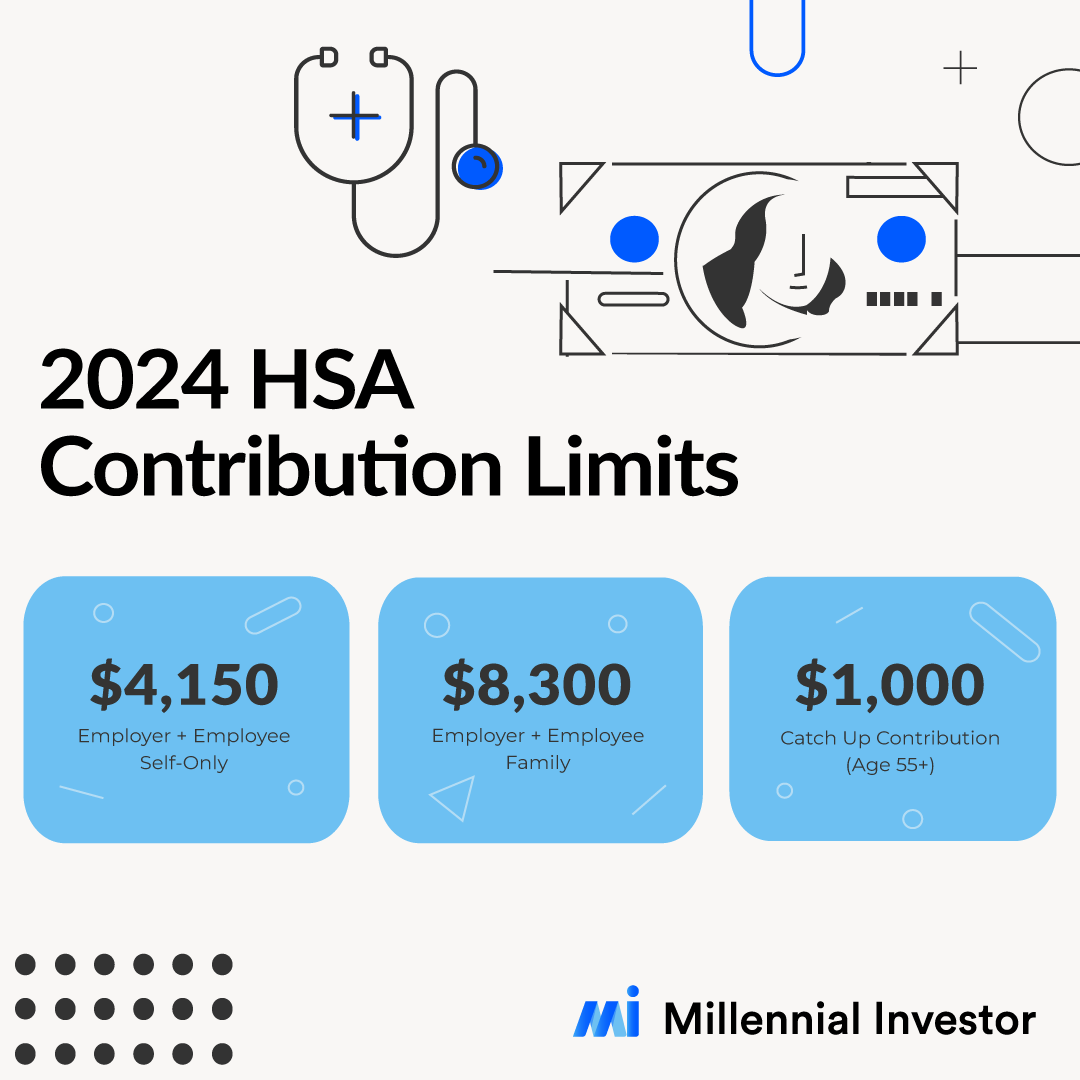

Contribution Limits 2024 Hsa - 2023 Dcfsa Limits 2023 Calendar, For 2024, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150. The maximum contribution for family coverage is $8,300. The maximum amount of money you can put in an hsa in 2024 will be $4,150 for individuals and $8,300 for families.

2023 Dcfsa Limits 2023 Calendar, For 2024, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150. The maximum contribution for family coverage is $8,300.

Irs Hsa Catch Up Contribution Limits 2024 Mandy Kissiah, Contribution limits apply to the calendar year (and tax year) and are adjusted for inflation by the irs each year. Annual hsa contribution limits for 2024 are increasing in one of the biggest jumps in recent years, the irs announced may 16:

Hsa members can contribute up to the annual maximum amount that is set by the irs. For 2024, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150.

Significant HSA Contribution Limit Increase for 2024, Hsa contribution limits for 2024 are $4,150 for singles and $8,300 for families. The health savings account (hsa) contribution limits effective january 1, 2024, are among the largest hsa increases in recent years.

What’s the Maximum 401k Contribution Limit in 2022? (2023), View contribution limits for 2024 and historical limits back to 2004. This is a $150 increase for individuals and a $250 increase for families from the 2024 hsa contribution limits.

2023 Hsa Minimum Deductible W2023D, Hsa members can contribute up to the annual maximum amount that is set by the irs. The maximum contribution for family coverage is $8,300.

Contribution Limits Increase for Tax Year 2024 For Traditional IRAs, Hsa contribution limits for 2024. For 2024, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150.

Max Amount Hsa 2024 Ashli Camilla, The maximum contribution for family coverage is $8,300. For 2024, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150.

With inflation remaining elevated, the irs has increased the amount of money that individuals and families can save in their hsas in 2024.

Hsa Annual Maximum 2024 Cami Marnie, Employer contributions count toward the annual hsa. Annual hsa contribution limits for 2024 are increasing in one of the biggest jumps in recent years, the irs announced may 16:

Contribution Limits 2024 Hsa. This is a $150 increase for individuals and a $250 increase for families from the 2024 hsa contribution limits. The contribution limit increases are the largest on.

What Is The Max Amount For Hsa In 2024 Cary Tiphanie, Employer contributions count toward the annual hsa. With inflation remaining elevated, the irs has increased the amount of money that individuals and families can save in their hsas in 2024.

The maximum contribution for family coverage is $8,300.

For 2024, the hsa contribution limit is $4,150 for an individual, up from $3,850 in 2023.

Annual 401k Contribution 2024 gnni harmony, This is a $150 increase for individuals and a $250 increase for families from the 2024 hsa contribution limits. The hsa contribution limit for family coverage is $8,300.