New Inherited Ira Rules 2025 - If your son inherited 25% of his uncle’s ira, for example, he can only claim a $5,000 tax exclusion. Take entire balance by end of 5th year following year of death. The New Inherited I.R.A. Rules Brio Financial Group, If your son inherited 25% of his uncle’s ira, for example, he can only claim a $5,000 tax exclusion. Four things every beneficiary should know.

If your son inherited 25% of his uncle’s ira, for example, he can only claim a $5,000 tax exclusion. Take entire balance by end of 5th year following year of death.

Inherited IRA Rules Before and After the SECURE Act AAII, Inherited ira rules & secure act 2.0 changes. Four things every beneficiary should know.

1, 2020 will generally be subject to new secure act rules.

YearEnd Planning RMD & Inherited IRA Strategies Relative Value Partners, For 2025, the ira contribution limit is $7,000. The irs intends to issue final rmd regulations that will apply for calendar years beginning no earlier than 2025.

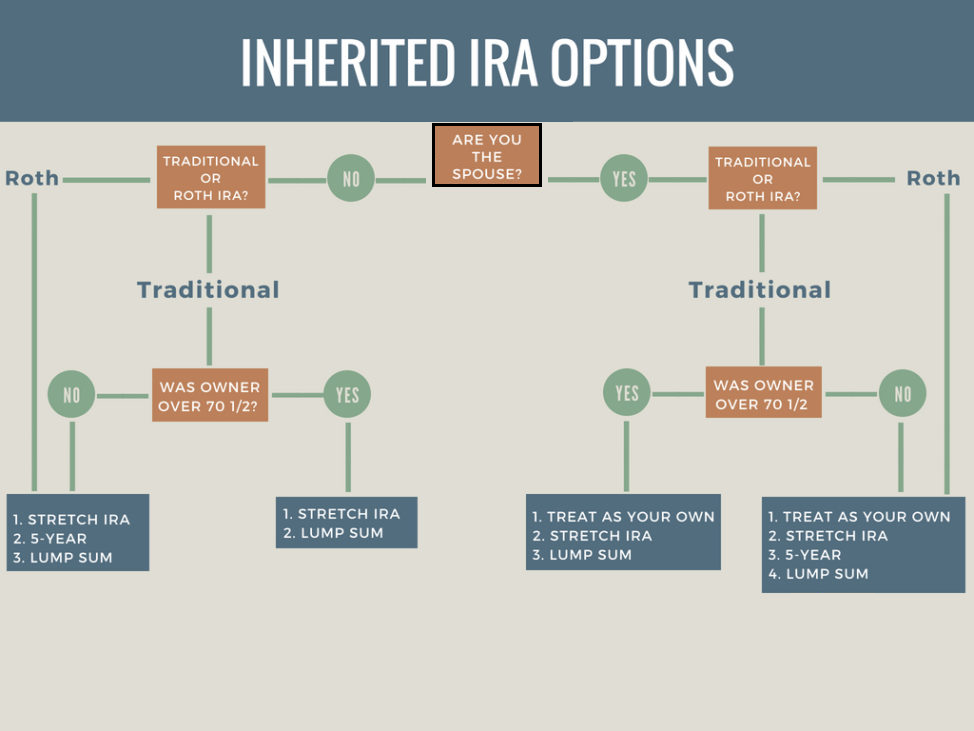

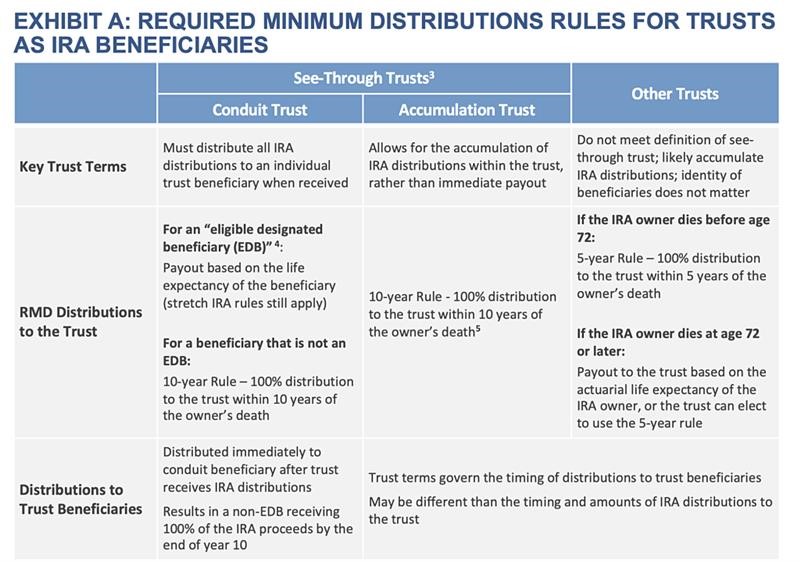

The New Inherited I.R.A. Rules 6 Meridian, When you inherit an ira, many of the irs rules for required minimum distributions (rmds) still apply. The secure 2.0 act of december 2022 expanded on this benefit for spousal beneficiaries of retirement plans such that those beneficiaries could elect to be.

In the first quarter of 2025, americans held more than $12 trillion in.

Inherited IRA RMD Calculator to Maximize Your Inheritance (2025), If your son inherited 25% of his uncle’s ira, for example, he can only claim a $5,000 tax exclusion. Participants, ira owners, and beneficiaries in connection with the change in.

In the first quarter of 2025, americans held more than $12 trillion in.

When you inherit an ira, many of the irs rules for required minimum distributions (rmds) still apply.

New Inherited Ira Rules 2025. The rmd rules for inherited iras apply to both traditional and roth accounts. An inherited ira is an individual retirement account that you are willed upon the previous owner’s passing.

Inherited IRA Rules When Inheriting an IRA from Your Spouse, Taxes may be guaranteed, but that doesn’t. New rules for inherited iras could leave some heirs with a hefty tax bill.

Inheriting an IRA from your Spouse? Know Your Options New Century, The rules on inherited defined contribution plans (not just iras). Also, the total exclusions claimed by the deceased.

The irs has said that they expect to release final guidance in 2025.

What are the New Rules for Inherited IRAs? Inflation Protection, Also, the total exclusions claimed by the deceased. Its stated goals are to expand and increase.

Inherit An IRA? Are You Affected By New 2022 RMD Tables? — Julie Jason, Irs delays final ruling on changes to inherited ira required distributions until 2025, and extends the rmd penalty waiver to 2025 for certain. The irs has resolved a dispute over new rules for inherited iras by punting enforcement of new withdrawal guidelines to 2025.

Confused By The New SECURE Act’s 10Year Rule For Inherited IRAs?, You've just inherited an ira: The rmd rules for inherited iras apply to both traditional and roth accounts.